How Much Money Should I Save Before Buying A House?

How Much Money Should I Save Before Buying a House?

The first few years of home-ownership are difficult, especially with all that financial stuff you have to manage. Home can be one of the most expensive purchases you make. And most people don’t know how much money they should save before buying a home. How much money should you save before buying a house? Find out the key things you need to consider before purchasing!

The Average Cost of Buying a House

The cost of purchasing a property will vary according to individual conditions since several things are involved. Here, we’ll discuss some of the most common home-buying costs and their associated averages. This information may be used to get a personalized estimate for yourself.

Down Payment

Your down payment will almost certainly be the highest cost of the home buying process. Numerous purchasers strive to save at least 20% of the purchase price of the property they want to acquire. A 20% down payment is required to avoid paying private mortgage insurance (PMI) on a conventional mortgage, the most typical type of mortgage.

For instance, the typical sales price of a house in Q3 2021 was $404,700, which means that you will need to save $80,940 to make a 20% down payment.

On the other hand, many government-sponsored mortgages demand a substantially lower down payment. For first-time buyers, for example, FHA loans demand as little as 3.5 percent down. For individuals who qualify, VA loans may not need any money down.

On any loan, it’s still preferable to make a 20% or more down payment to avoid paying PMI and reduce the amount borrowed.

Closing Fees

Closing expenses are another high price to consider when estimating the cost of purchasing a house. These prepared charges include title insurance, the house inspection, and appraisal fees, escrow account setup fees, property taxes, insurance, and mortgage origination fees.

Closing expenses typically range between 2% and 5% of the home’s buying price. Thus, budgeting 5% for closing costs on a $404,700 median-priced property would need $20,235 in savings.

Some of these expenses may be included in your mortgage. However, if you pay them in full upfront, you will avoid the need for further borrowing. Additionally, your lender should provide you with a loan estimate that details all of the closing expenses associated with the loan, including which ones you may save by shopping around.

Moving Costs

Whether you decide to manage the relocation yourself or employ professional movers, you’ll almost certainly need to budget for it. You can save money by doing it yourself, but you’ll need a car, a large supply of extra boxes, and the time and muscle to transport your belongings.

The cost of your relocation will vary according to the value of your purchases, and the distance traveled. According to Pods, a renowned moving company, the average cost of a full-service relocation from New York City to San Francisco is between $3,893 and $7,230.7.

Pre-Move-In Remodeling and Repairs

You’ll almost certainly want to improve your property before moving in, from replacing the door lock to repainting and installing new flooring.

Until you select a house, you will have no idea what renovations or repairs would be necessary. However, you may budget for some of the costs associated with this work in your savings plan.

New Furniture and Decorating

It takes years and a lot of money to furnish and decorate a house. However, you may choose to immediately update your décor or get new furnishings.

If your new house does not have a complete suite of equipment, you may need to acquire a refrigerator or washer and dryer.

Costs of decorating and furnishings will vary according to your preferences and requirements. This is another expense that you may deduct from your down payment fund if necessary; however, keep in mind that doing so will raise the amount of money you need to borrow.

Fees for Vacate

You may be charged costs such as lease-breaking (early termination) or cleaning fees when you leave if you are presently renting. If you are already a homeowner, selling your property will include certain costs, such as real estate commission.

Fund to Repair, Your First Home

Consider setting up a separate home repair fund to cover unforeseen repairs without jeopardizing your budget or incurring debt. The fund may cover expenditures such as water heater or furnace replacement, or refrigerator repair.

Most experts recommend allocating around 1% of your house’s worth on home upkeep each year.

That’s $4,047 per year or $337.25 every month on a $404,700 property.

How Much Money Do I Need to Buy a House?

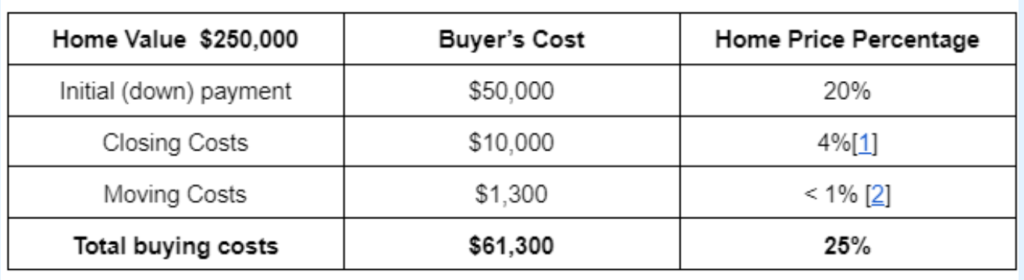

If you’re considering a mortgage, a wise method to purchase a home is to save at least 25% of the purchase price in cash for a down payment, closing charges, and moving expenses. Thus, if you purchase a property for $250,000, you may pay more than $60,000 in total closing costs.

To provide insight, the following is an example of a possible home-buying budget:

If these figures seem high, you are not alone. Indeed, most purchasers saved up to 12% of the purchase price as a down payment last year—down from 20% 30 years earlier![3] So, what occurred during the last three decades that caused house purchasers to quit saving as much money before purchasing a home?

Student debt is the leading reason why today’s house buyers (51 percent) are having difficulty saving for a down payment—followed by credit card debt (45 percent) and vehicle loans 38%.

That is why, before purchasing a property, you should be out of debt as soon as possible and have a fully established emergency fund.

Saving Money in the Short and Long Term

The purchase of one’s first house is a traditional achievement. When it comes to saving for a first house, many people are unsure how much money they should have saved.

To begin, it’s critical to prevent surprises throughout your house acquisition. A smart approach is to engage with the Single Tree Team of real estate professionals throughout the home buying process to determine the cash you should have on hand to close your house.

Savings in the Short Term

If you begin saving 20% of your monthly salary, you may be able to qualify for a loan with a fair interest rate and also have a sufficient down payment available. When determining how much money you should save, you should pay special attention to your gross income (vs. net).

For example, someone earning $100,000 per year who saved 20% of their salary would have saved $20,000 in 12 months. After another six months, this would be $30,000 (exclusive of interest) and could be put toward a down payment and closing fees.

Longer-Term Plans

If you have the time and patience to wait and save for a house, saving 10% of your salary will take longer but may provide you more freedom in deciding when and where to buy a property.

This is far from simple – it takes discipline to continuously set aside a percentage of your monthly income in light of any other costs you may have.

However, if you can survive on a somewhat reduced income, you should also focus on improving your credit score. A better credit score may include paying a cheaper interest rate, allowing you to purchase more homes for your money.

Buy a House With a Top Real Estate Professionals

It is always a happy experience to buy a new house, especially when it’s your own house. If you are looking forward to buying your property, the Single Tree Team Realty is there for you at each and every step. We understand that home buying is one of the biggest decisions of your life, and as such, we make sure to provide you with all the information required to help you make the right decision. Plus, there’s no need for you to be nervous because we will be with you until the very end of your property purchase. Our top-notch real estate agents in Belleville, Illinois, and Kirkwood, Missouri, offer professional guidance and assistance from start to finish.